Consider REITs for Income and Diversification

Real estate investment trusts (REITs) can offer a consistent income stream and help provide portfolio diversification. Considering these potential benefits, it may not be surprising that an estimated 80 million Americans own REITs in their retirement accounts and other investment funds.1 Of course, like all investments, REITs also have risks and downsides.

Pooled Property Investments

An equity REIT — the most common type of REIT — is a company that uses the combined capital of a large number of investors to buy and manage residential, commercial, and industrial income properties. A REIT may focus on a specific type of property, but REIT properties in general might range from shopping malls, apartment buildings, and medical facilities to self-storage facilities, hotels, cell towers, and timberlands. Equity REITs derive most of their income from rents.

Under the federal tax code, a qualified REIT must pay at least 90% of its taxable income each year in the form of shareholder distributions. Unlike many companies, REITs generally do not retain earnings, so they may provide higher distribution percentages than some other investments. At the end of Q1 2019, equity REITs paid an average distribution of 3.72%, almost double the 2.00% average dividend paid by stocks in the S&P 500 index.2

You can buy shares in individual REITs, just as you might buy shares in any publicly traded company, or you can invest through mutual funds and exchange-traded funds (ETFs).

Income vs. Volatility

Equity REITs are effective income-generating assets, but share prices can be sensitive to interest rates, partly because companies often depend on debt to acquire rent-producing properties, and interest rates can affect real estate values. Also, as rates rise, REIT distributions may appear less appealing to investors relative to the stability of bond yields.

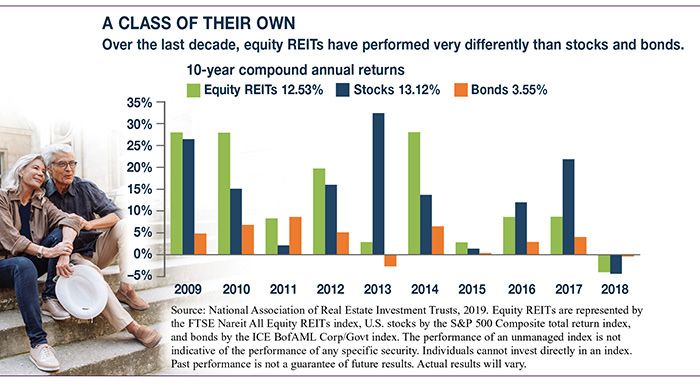

For buy-and-hold investors, the income from REIT distributions may be more important than short-term share-price volatility. Moreover, REIT share prices do not always follow the stock or bond markets, making them a helpful diversification tool (see chart). In fact, while REITs are traded on the stock market, they are in some respects a unique asset class with characteristics of both stocks and bonds. So holding REITs not only may diversify your stock holdings but might also broaden your approach to asset allocation. Diversification and asset allocation are methods used to help manage investment risk; they do not guarantee a profit or protect against investment loss.

Real Estate Risks

There are inherent risks associated with real estate investments and the real estate industry that could adversely affect the financial performance and value of a real estate investment. Some of these risks include a deterioration in national, regional, and local economies; tenant defaults; local real estate conditions, such as an oversupply of, or a reduction in demand for, rental space; property mismanagement; changes in operating costs and expenses, including increasing insurance costs, energy prices, real estate taxes, and the costs of compliance with laws, regulations, and government policies.

The return and principal value of all investments, including REIT shares, fluctuate with changes in market conditions. Shares, when sold, may be worth more or less than their original cost. Supply and demand for ETF shares may cause them to trade at a premium or a discount relative to the value of the underlying shares. REIT distributions often reflect a return of capital or other non-income sources, and such distributions are not guaranteed. Investments seeking to achieve higher returns also involve a higher degree of risk.

Mutual funds and ETFs are sold by prospectus. Please consider the investment objectives, risks, charges, and expenses carefully before investing. The prospectus, which contains this and other information about the investment company, can be obtained from your financial professional. Be sure to read the prospectus carefully before deciding whether to invest.

1–2) National Association of Real Estate Investment Trusts, 2019

Investing in Real Estate Investment Trusts (REITs) involves special risks such as potential illiquidity and may not be suitable for all investors. There is no assurance that the investment objectives of this program will be attained.

This information is not intended as tax, legal, investment, or retirement advice or recommendations, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek advice from an independent professional advisor. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Broadridge Advisor Solutions. © 2019 Broadridge Investor Communication Solutions, Inc.